New borrowings under the “Paycheck Protection Program” (PPP) promulgated under The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), the sweeping coronavirus relief package signed into law by President Trump on March 27, 2020, have come to an end and borrowers under the program are moving into the forgiveness and/or repayment phase of PPP. PPP was designed for loans made under the program to be forgiven by the private sector banks charged by the Small Business Loan Administration (SBA) with lending the funds. The PPP funds lent by banks are supported by a guaranty by the SBA, making those banks whole if the loans are forgiven or the borrowers obligated to repay do not do so. Despite that, almost since borrowings started under PPP, the U.S. Treasury Department, the SBA and some U.S. Senators and Members of Congress have tried to chip away at the forgiveness rights of borrowers of loan amounts, $2,000,000 or greater (Large Loan Borrowers or LLBs), due to concern by the government that too many “unintended” companies benefited by borrowing under PPP without need for the funds (often referred to as a “necessity test”).

Putting aside government efforts to prevent forgiveness for LLBs, certain qualified PPP borrowers will not, under the program, be entitled to 100% forgiveness of their loans, but rather their forgiveness amount will be prorated based on the extent of compliance with PPP’s requirements (Prorated Borrowers or PBs). Some of the circumstances resulting in prorated forgiveness include:

- a borrower spent all of the borrowed funds on permitted expenses under PPP, but not at the percentage required to be spent on payroll,

- a borrower’s reduction of salaries of employees below 25% of pre-pandemic amounts, or

- a borrower’s furloughing, reducing hours of or laying off of employees compared to the borrower’s pre-pandemic workforce.

If a borrower receives either a forgiveness amount determination less than they believe is justified or was determined (on a post-borrowing basis) ineligible for PPP funds at all, what can be done? What avenues can the borrower pursue?

Seeking Forgiveness

Applying for Forgiveness.

All PPP borrowers are to apply for forgiveness at the end of their “Covered Period” (which is either an 8 week or 20 week period measured from the date the borrower’s PPP loan was funded). Some borrowers have begun applying for forgiveness, which includes providing the lending bank supporting documentation (usually prepared with support from the borrower’s payroll provide and accounting firm) demonstrating compliance with the qualified spending categories and timeframes and with the salary and retention requirements under PPP. The forgiveness application process is where the borrower will claim 100% or prorated forgiveness. Once a borrower’s application is submitted the lending bank has 60 days to provide a determination on forgiveness.

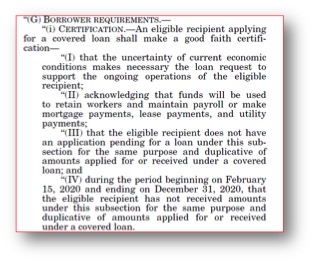

On May 13, 2020, SBA in consultation with the U.S. Treasury Department, announced that all LLBs will be the subject of a mandatory SBA audit, in addition to their LLB lending bank’s forgiveness determination. The purpose of the audit is to determine a threshold question of whether the LLBs were ever eligible to be a borrower under PPP by examining the veracity of the LLB’s certifications under its loan application, including whether the PPP loans were a necessity for such LLB:

The SBA audit is to be completed 90 days following a lender’s forgiveness determination for an LLB. We do not believe a bank’s forgiveness determination includes an assessment as to whether an LLB properly made its certifications. That is left for the SBA.

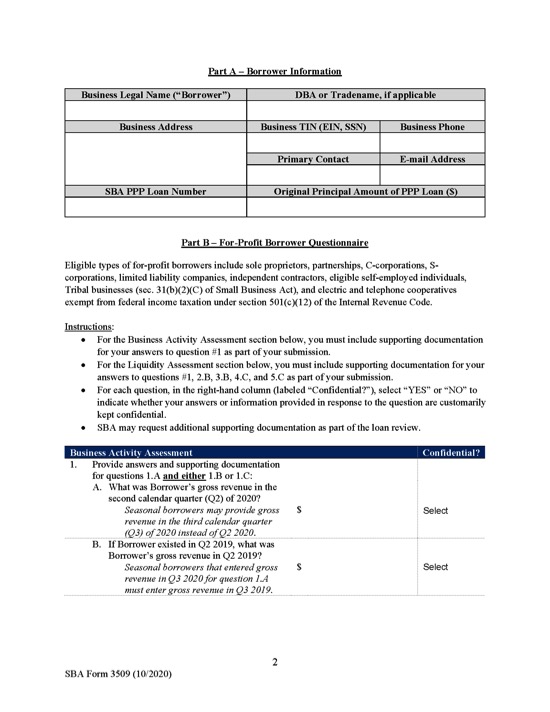

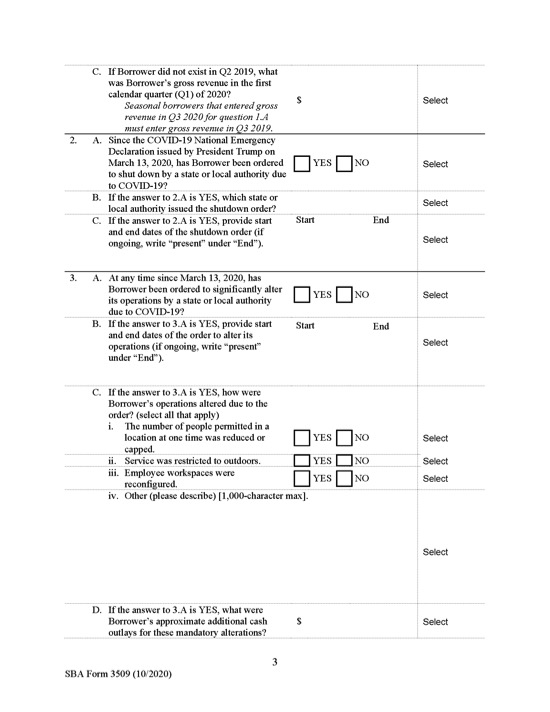

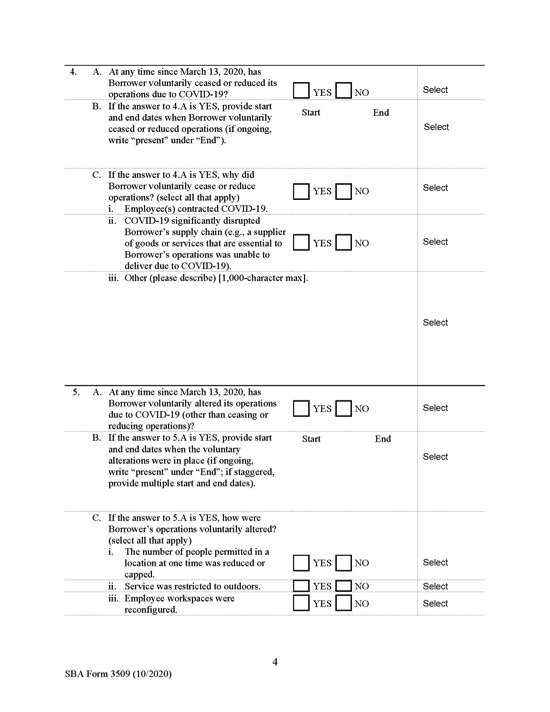

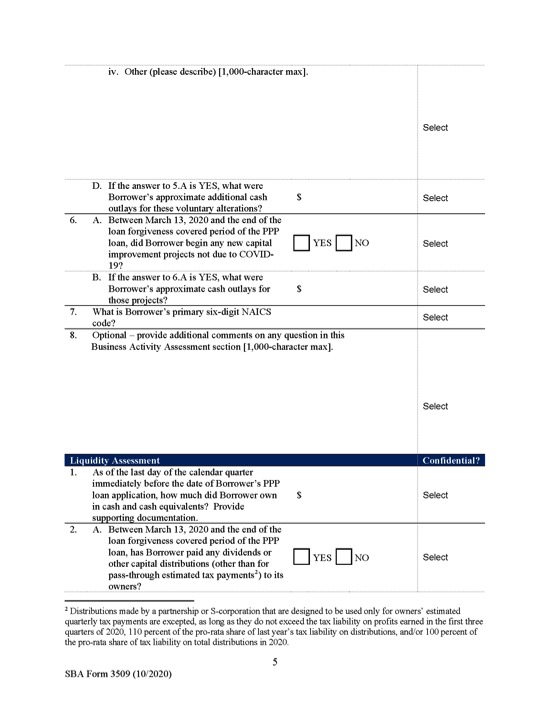

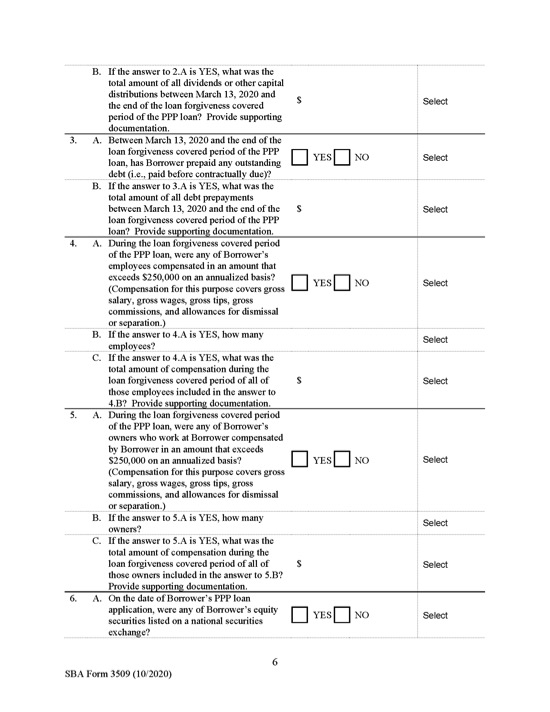

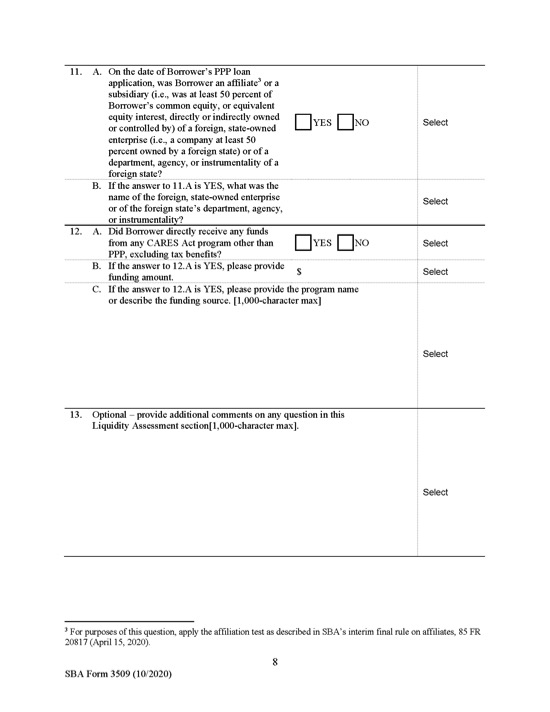

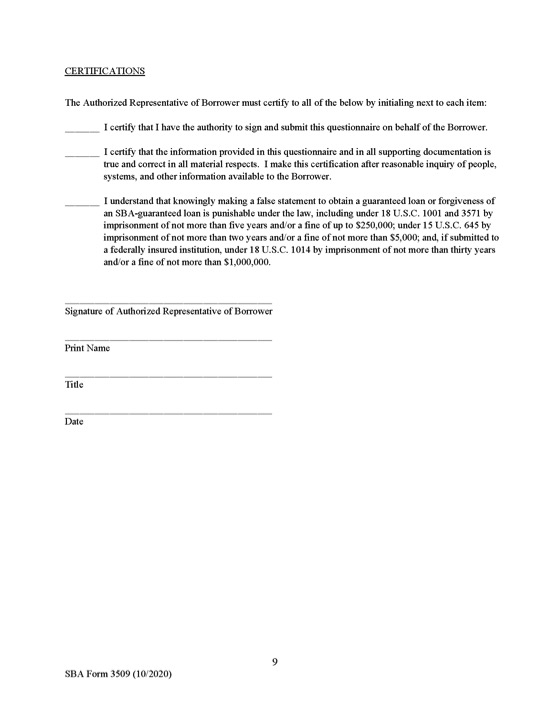

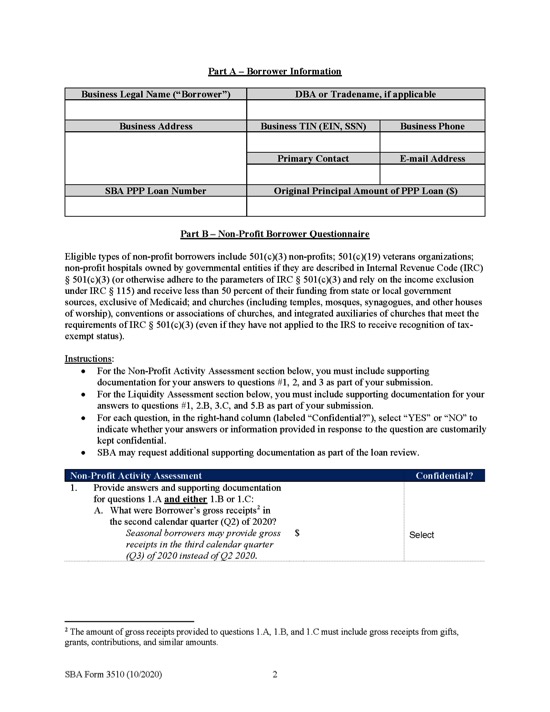

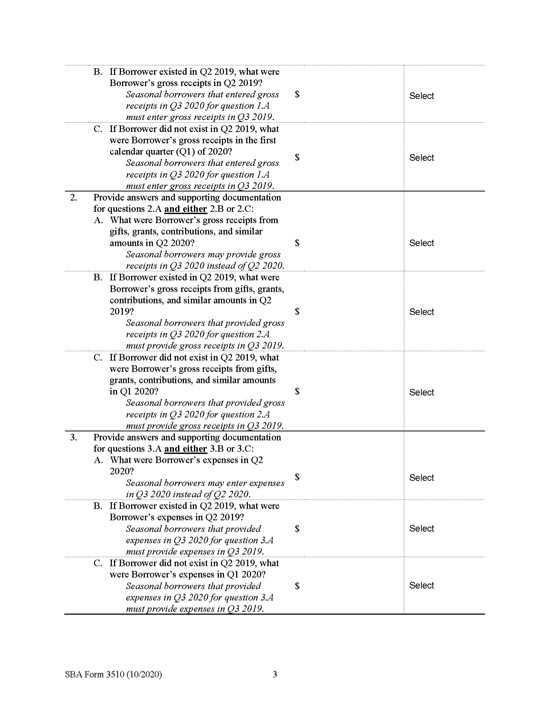

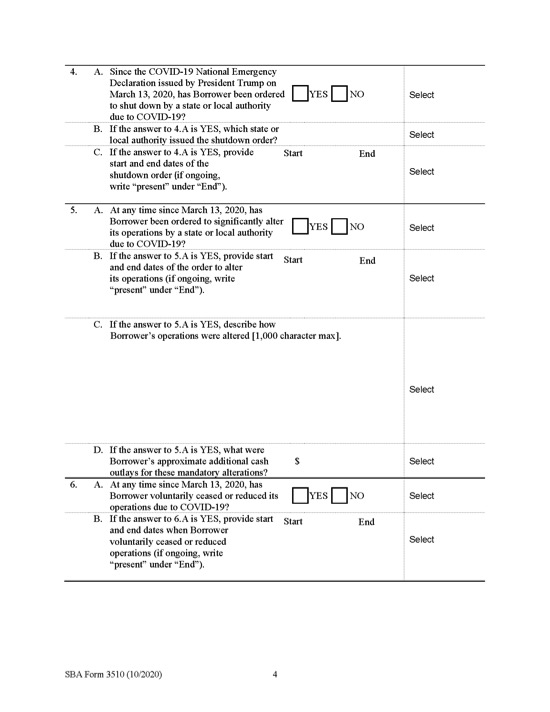

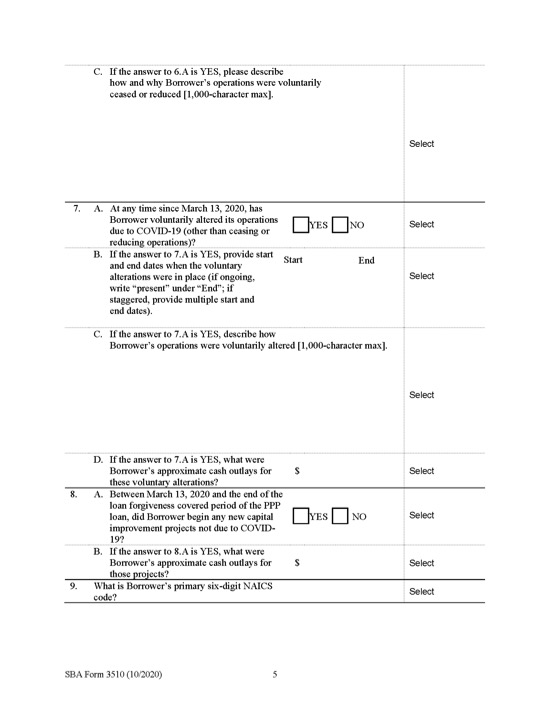

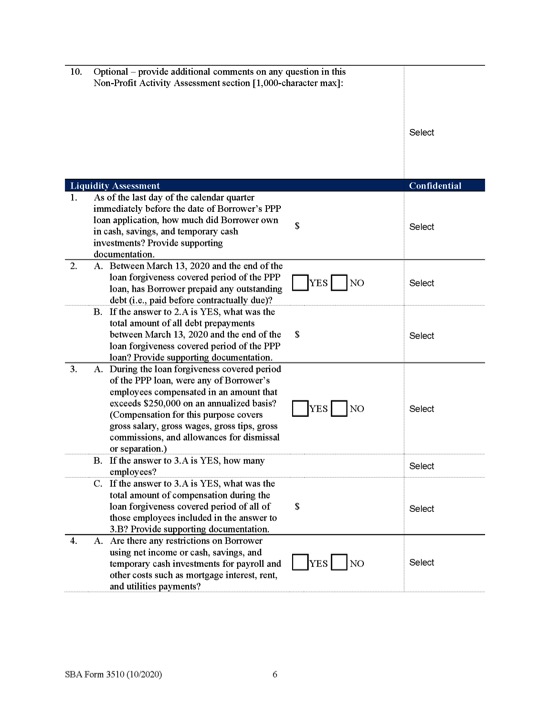

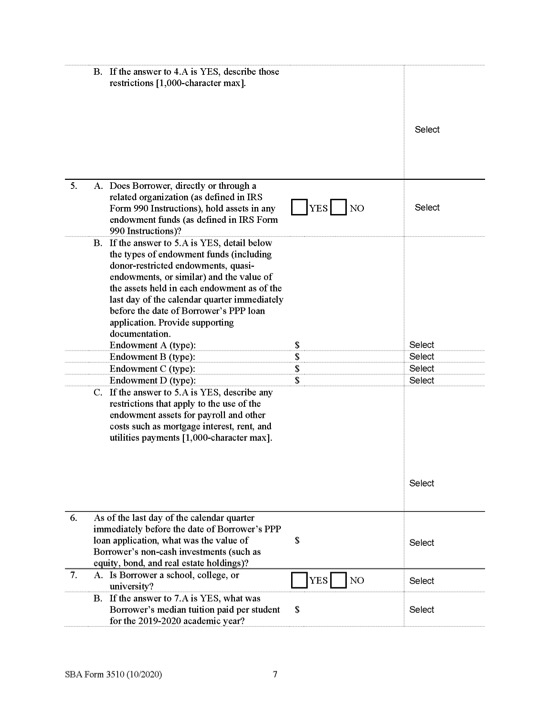

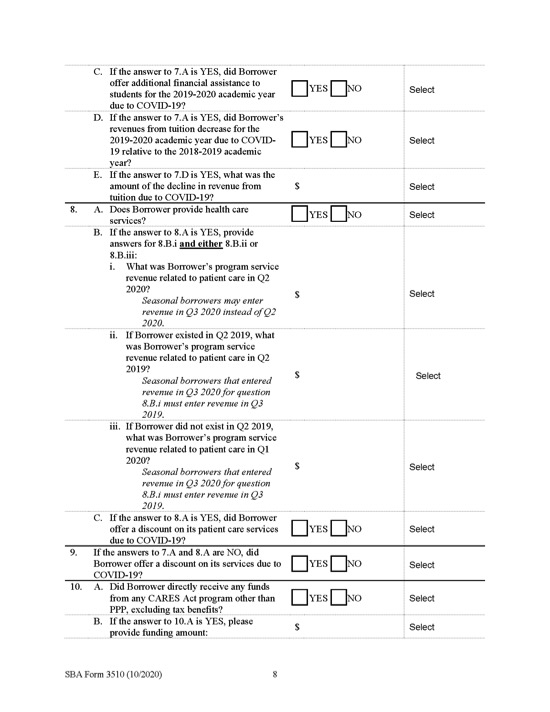

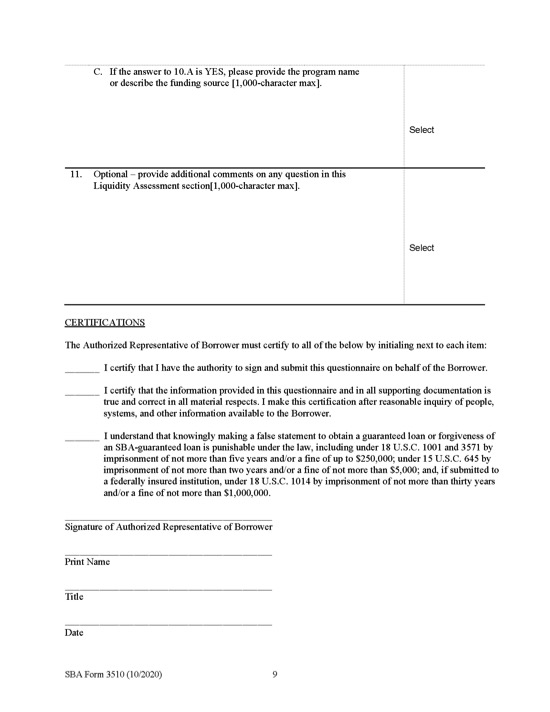

SBA Questionnaire. On October 26, 2020, SBA published a notice in the Federal Register requesting comments on two new PPP forms. That notice made reference to two new SBA forms, SBA Form 3509—Loan Necessity Questionnaire (For-Profit Borrowers) and SBA Form 3510—Loan Necessity Questionnaire (Non-Profit Borrowers). Those forms do not appear on the SBA website and do not seem to be officially, publicly available, but both forms have been widely published on various non-government websites and are included at the end of this alert for reference.

Both forms are questionnaires and state that their intended purpose is to assist SBA in evaluating whether LLBs made good faith certifications in their PPP loan applications as to the necessity of the loans. The forms request information regarding actual performance in the second quarter of 2020, other potential sources of liquidity that were available to the LLB and other information that suggests a retrospective analysis of whether the loan funds were necessary, rather than the subjective perspective of the LLB at the time of borrowing that PPP funds were necessary to support its ongoing operations in light of to the “economic uncertainty” caused by the COVID-19 pandemic (which is the standard of assessment as set forth in the CARES Act). The forms also inquire as to whether any owners or employees of the LLB received compensation during the “Covered Period” in an annualized amount in excess of $250,000. The question seems odd in connection with determining necessity for a loan as nothing under PPP capped salaries on a company’s payroll, but rather companies were not entitled to use PPP funds to pay the salaries of those highly compensated employees. The information sought by SBA in these unreleased forms have sent an uncomfortable chill through the LLB community and some concern that the government may be looking to reclaim as much of the PPP funds as they can from LLBs. The questionnaires require response from the LLB within 10 business days following receipt by the borrower from its lender, which may be difficult for some borrowers. The comment period expires on November 25, 2020. The questionnaires may be revised in light of the public comments.

Appealing Determinations

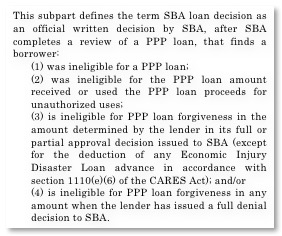

PPP Loans Subject to SBA Appeals Process. On August 27, 2020, SBA issued a rule specific to appealing SBA PPP loan review decisions. Under that rule, a determination by the SBA as to whether a borrower was a qualified borrower under the SBA program (whether an LLB or not) and whether a PPP loan is forgiven in full or in part, will be subject to the administrative law proceedings conducted by the SBA Office of Hearings and Appeals (OHA).

Preparing for Appeals.

The best thing a PPP borrower can do to prepare for an appeal is to never need the appeal to begin with! Borrowers should work closely with their internal and external HR, payroll, accounting and legal teams to provide PPP lenders with responsive, organized and easily understandable information in support of forgiveness applications.

Whether you are completing a forgiveness application or responding to additional requests for information by lenders, the SBA or other government agencies, remember take seriously your obligations to respond honestly and truthfully. A borrower should recognize that any statements (oral or written) or documents made to the government will be part of the “record” the government uses to make its determination, defeat any appeal and/or bring a civil or criminal action (if appropriate). Additionally, there are federal laws that make it a crime punishable by prison and/or fines for making false, fictitious, or fraudulent statements or representations or for providing false documents to the U.S. Government (including SBA) and banks (in connection with a borrowing). Please know that a company is not entitled to the same protections under the 5th Amendment (right to not incriminate oneself) in a government investigation or proceeding as an individual is. A company cannot assert a 5th Amendment right to keep from responding to a request for information from the government.

If despite a borrower’s efforts to provide its PPP lender (or the SBA) with information to demonstrate qualification for PPP and/or qualification for forgiveness, the borrower receives a negative determination the borrower will have to assess their specific situation and decide whether to appeal the determination to OHA. An effective appeal to OHA will likely require close coordination with a borrower’s legal counsel (which should be experienced with administrative law appeals) and its auditing firm.

Know that Smith, Gambrell & Russell, LLP stands at the ready to advise client on their forgiveness submissions and any subsequent information requests or appeals that may result.