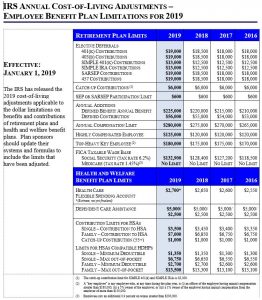

Effective January 1, 2019

The IRS has released the 2019 cost-of-living adjustments applicable to the dollar limitations on benefits and contributions of retirement plans and health and welfare benefit plans. Plan sponsors should update their systems and formulas to include the limits that have been adjusted.

For a printable version of this chart, click here. For more information on these cost-of-living adjustments, contact your SGR Executive Compensation and Employee Benefits counsel.

SGR is in the process of preparing our yearly laminated chart of benefit limitations, but in the interim, we wanted to provide you with a quick overview of the changes. If you have not been receiving our chart and would like to receive one once it is prepared, please click here.