-

Upcoming Cuts to Estate and Gift Tax Exemptions, and Importance of Prompt Decisions and Actions:

Most estate planning clients of SGR’s Private Wealth Trusts & Estates Practice Group are familiar with the unified estate and gift tax exemption. That exemption allows a donor or to transfer property during life or at death without paying gift or estate taxes, respectively. The base exemption was raised to $5 million in 2011 and has since been increased for inflation. (The exemption for the Generation-Skipping Transfer Tax, or “GST Tax,” has tracked that same exemption amount starting in 2011.) The base exemption was doubled for 2018 and subsequent years as part of the Tax Cuts and Jobs Act of 2017, and will be $13,610,000 for 2024 after taking into account inflation adjustments. However, that 2017 Act included a sunset provision for the doubling of the base exemption. Under current law, the increased estate and gift tax exemption will be cut in half at the end of 2025.

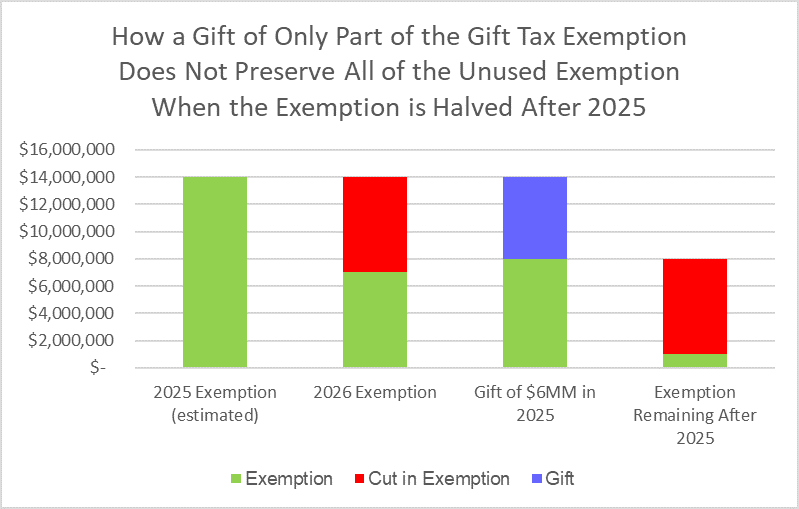

There are two important details about the halving of the estate tax exemption after 2025. The good news is that under Treasury Regulations, there will be no “claw back” of gifts made while the exemption has been doubled: a completed gift using the higher exemption amounts won’t be brought back into the donor’s taxable estate if the donor dies after the exemption is reduced. The bad news is that the exemption reduction is structured in a “use it or lose it” manner. Not all taxpayers are familiar with this latter component of the sunset provision, and may mistakenly think that gifts made before 2026 will be applied first to the portion of the exemption that will be taken away by the sunset provision. Instead, taxable gifts before the 2025 sunset of the exemption increase will be applied first to the exemption that will remain after the sunset, so that use of the exemption that will be lost after 2025 requires using more than half (if not all) of the currently available exemption.

Taking advantage of the current higher exemption thresholds allows taxpayers to significantly reduce the tax burden on their estates and intergenerational wealth transfers. Failing to leverage these exemptions before they are halved could greatly increase gift and estate tax liabilities for donors. The resulting tax increase would be an amount equal to the estate tax rate (currently 40%) times the amount of exemption that is lost without being used. If the lost exemption is $7,000,000, the resulting tax increase would be $2,800,000.

For ultra-high net worth taxpayers who wish to benefit their descendants, other relatives, and other non-charitable beneficiaries, it is a fairly easy call to make large gifts before 2026 in order to fully use the currently high gift and estate tax exemption. However, taxpayers who are “merely” high net worth might wonder if they can afford to give away enough to use their full exemptions before the sunset at the end of 2025. SGR has been helping such taxpayers by using techniques that are completed gifts and can use the full exemptions before 2026, but that may allow the donors use of the transferred property. If you would like to hear more about such techniques (or other techniques) allowing you to use your large gift and estate tax exemptions before those are cut in half, please contact an attorney in SGR’s Private Wealth, Trusts & Estates practice group.

In light of these considerations, the importance of using the estate and gift tax exemption before the impending reduction cannot be overstated. By acting proactively and leveraging the current favorable exemption limits, individuals can secure their legacies, provide for their families, and protect their wealth from unnecessary taxation. Estate planning is a complex endeavor that requires careful consideration, and taking advantage of the existing exemption thresholds offers a crucial opportunity to safeguard financial well-being for generations to come.

-

Changes to Estate and Gift Tax Exemptions, Exclusions for 2024, and January 2024 Interest Rates Used in Estate Planning:

-

Impact of Corporate Transparency Act on Estate Planning Structures Such as Family Partnerships and LLCs (but not Common Law Trusts):

The full implementation of the Corporate Transparency Act (“CTA”) starting January 1, 2024 will trigger new reporting requirements for entities, including many estate planning structures. Designed to enhance transparency and curb illicit financial activities (such as money laundering and tax evasion), the CTA mandates the disclosure of beneficial ownership information for these entities to the Financial Crimes Enforcement Network (“FINCEN”). Initial required reports for entities existing on January 1, 2024 will generally be due by the end of 2024, while entities formed after 2023 will need to report and updated reports will be required when there are changes in beneficial ownership.

As the CTA targets corporations, limited partnerships (“LPs”), and limited liability companies (“LLCs”), it will affect estate planning arrangements that utilize these structures for wealth management and succession purposes, including family limited partnerships (“FLPs”) and family limited liability companies (FLLCs). As a result, families (and their family offices and other advisors) utilizing FLPs and FLLCs as part of their advanced estate planning strategies will need to adapt.

FLPs and FLLCs have been popular tools in advanced estate planning due to their flexibility and potential tax benefits. These structures allow families to consolidate assets, manage wealth, and transfer assets to future generations. However, the CTA’s requirement for disclosing beneficial ownership information may disrupt the confidentiality that some families value in these arrangements. Previously, these structures provided a level of privacy, enabling families to shield their financial affairs. With the increased transparency mandated by the CTA, families might reconsider using FLPs and FLLCs in their estate planning. However, after consulting with their attorneys and other advisors, many families will conclude that the benefits of those structures outweigh the burdens of reporting under the CTA.

Family trusts will generally not have to directly report under the CTA; but a trust’s trustee will have to provide disclosures of the trust’s beneficial ownership to LPs and LLCs (including FLPs and FLLCs) who will be required to report to FINCEN under the CTA. As beneficial interests in trusts change, such as when beneficiaries are born or die, trusts will have to update their disclosures to the reporting entities in which such trusts participate.

-

Expansion of SGR’s Post-Merger Estate Planning Capabilities:

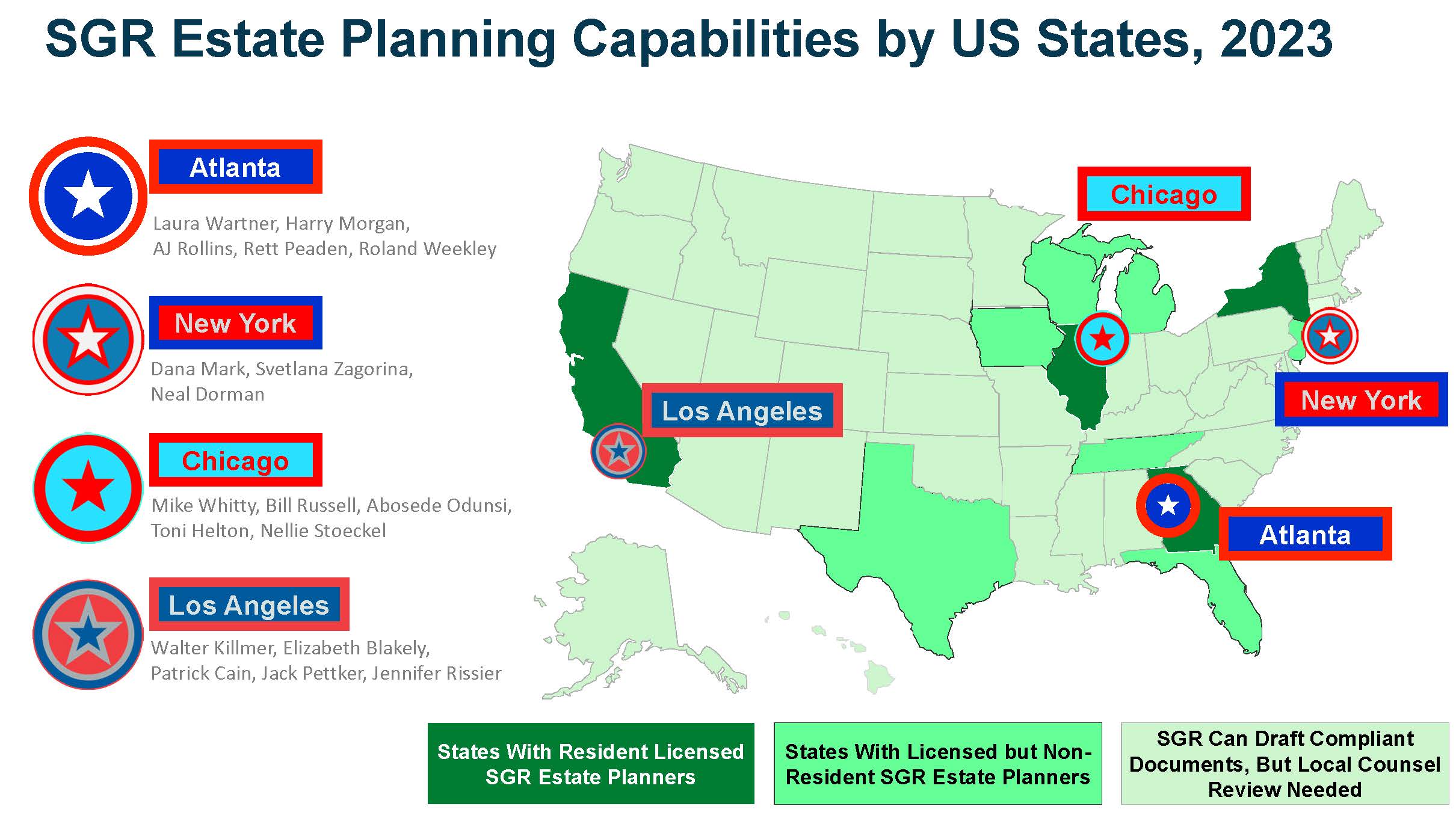

In April 2023, Smith Gambrell and Russell LLP significantly broadened the geographical scope of its Private Wealth, Trusts & Estates practice through a strategic combination with Freeborn & Peters LLP. This combination has empowered the firm to extend its services across a more extensive network of states. The combination not only brings together the expertise of both firms in estate planning but also establishes a robust presence in new jurisdictions, allowing SGR to offer comprehensive and tailored solutions to a more extensive clientele.

In addition to having practitioners licensed in eleven states (including the four largest and seven of the top ten by population), SGR is able to provide its estate planning expertise in all other states and the District of Columbia by consulting with local counsel.

If you have any questions regarding this client alert, please contact your Private Wealth Services counsel at Smith, Gambrell & Russell, LLP.