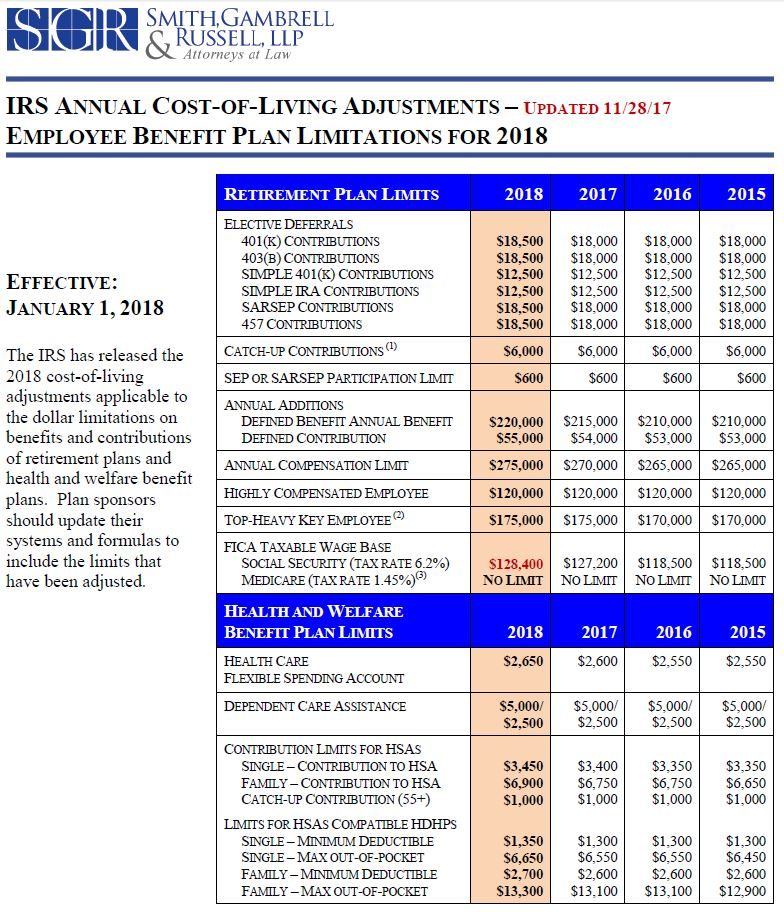

On November 27, 2017, the Social Security Administration announced it is revising the 2018 Taxable Maximum Amount, effective January 1, 2018. Originally, it had announced that the Social Security taxable maximum would be increasing to $128,700 for 2018. However, based on updated wage data, this number has now been adjusted to $128,400.

For a printable version of this chart, click here.

For more information on these cost-of-living adjustments, contact your SGR Executive Compensation and Employee Benefits counsel.

SGR is in the process of preparing our yearly laminated chart of benefit limitations, but in the interim, we wanted to provide you with a quick overview of the changes. If you have not been receiving our chart and would like to receive one once it is prepared, please click here.